Accountants, Tax and Business Advisers

Welcome to Mercian Accountants – Your Trusted Partners in Financial Growth

At Mercian Accountants, we pride ourselves on delivering tailored accounting solutions that cater to the unique needs of businesses of every scale. Our expertise extends from meticulous bookkeeping to strategic tax planning, all designed to propel your financial aspirations and business growth.

As a distinguished UK accounting firm, we are dedicated to serving clients across the UK and internationally, including individuals and businesses. Our comprehensive services include bookkeeping, tax planning, cutting-edge cloud accounting, payroll management, wills and probate services, and more, ensuring a one-stop solution for all your financial needs.

Our commitment goes beyond just providing services. We are your guides and supporters in the financial landscape, offering solutions and the peace of mind and assurance that comes with knowing your financial matters are in expert hands. Staying abreast of the latest technical and legislative changes, we ensure our approach continually adapts to meet the evolving needs of businesses and private individuals.

Join us at Mercian Accountants, where your financial success and aspirations are our top priority.

Google Reviews

See what our clients say about us in their own words. Here are a few of the most recent ones, and you can see many more on our Google Reviews page.

Stamp Duty Land Taxes 2024/25

We present our summary of Stamp Duty Land Taxes 2024/25. For our summary of the Spring 2024 Budget, please click here. For our summary of the 2024/25 Tax Rates and Allowances, please click here. Related posts: Mini Budget Tax Cuts Reversed by New Chancellor Autumn Statement 2022: Key Tax Change Highlights A simple guide to…

2024/25 Tax Rates and Allowances

We present our summary of the 2024/25 Tax Rates and Allowances. For our summary of the Spring 2024 Budget, please click here, and for 2024/24 Stamp Duty Land Taxes, please click here. Related posts: Mini Budget Tax Cuts Reversed by New Chancellor Stamp Duty Land Taxes 2024/25 Emergency Mini-Budget 2022 – Key Highlights Autumn Statement…

Spring Budget 2024 Summary

The Chancellor presented the last spring budget before the election. He emphasised the importance of implementing reforms to ensure a straightforward and equitable tax system that aligns with economic changes and aids public finances. Similar to previous budgets, ongoing discussions are ongoing, and additional information will be released in the coming weeks. This guide contains…

Property118, Cotswold Barristers, and HMRC

If you are or have been a client of Property118 or Cotswold Barristers, please seek urgent independent tax and legal advice. We’ve been watching with a growing sense of dread the saga unfolding over at Tax Policy Associates about these firms. Property118 and Cotswold Barristers operate together, offering a tax avoidance scheme for buy-to-let landlords.…

Is your company in possession of any residential property valued at over £500k?

If so, it is necessary for you to complete an ATED return (Annual Tax on Enveloped Dwellings) and fulfill the corresponding tax obligations. ATED returns are due in April each year for the following tax year. Therefore, for the 2024/2025 tax year, ATED Returns ought to have been submitted to HMRC by 30 April 2024,…

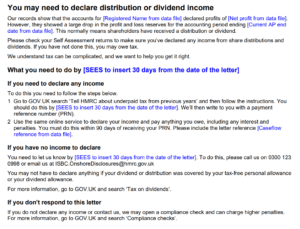

HMRC letters to company directors on undeclared dividend income

HMRC is contacting Company directors suspected of receiving dividends without declaring the income on their Self-Assessment Tax Returns Business owners have been receiving letters from HMRC as part of a recent campaign. These letters notify them about the potential requirement to declare dividend income. HMRC has been conducting investigations on company reserves, specifically targeting those…

Understanding Capital Gains Tax Rate: Your Comprehensive Guide

Seeking the capital gains tax rate? Whether you’re a basic or higher rate taxpayer, it’s essential to understand how much you’ll owe when selling assets like shares or property. This article breaks down the rates, guides you through the calculation process, and shares tax-saving strategies. Get the clarity you need to navigate the complexities of…

What We Offer

Bespoke, professional service

Mercian offers a personal and bespoke service, providing solutions that are tailored to each client.

A modern approach

At Mercian we embrace technological advances.

We use the latest tax and accountancy software and provide you with online access to your information at any time.

No-fuss fixed fees

High-quality advice doesn’t have to come with a high price tag attached. Value for money is at the heart of what we do, and with our fixed fees there are no nasty surprises.

Ready to Build Your Financial Future? Connect with Us Today!

Start on the path to financial clarity and success with Mercian Accountants. Whether you're looking to streamline your business finances, optimise tax strategies, or need expert guidance through complex financial landscapes, our team is here to assist.

Contact us now to schedule a consultation and discover how we can tailor our accounting expertise to your unique needs. Let's work together to turn your financial goals into reality.

Schedule a Consultation Learn More About Us

Your financial success story starts here. Reach out to Mercian Accountants – where every client is a priority, and every challenge is an opportunity.